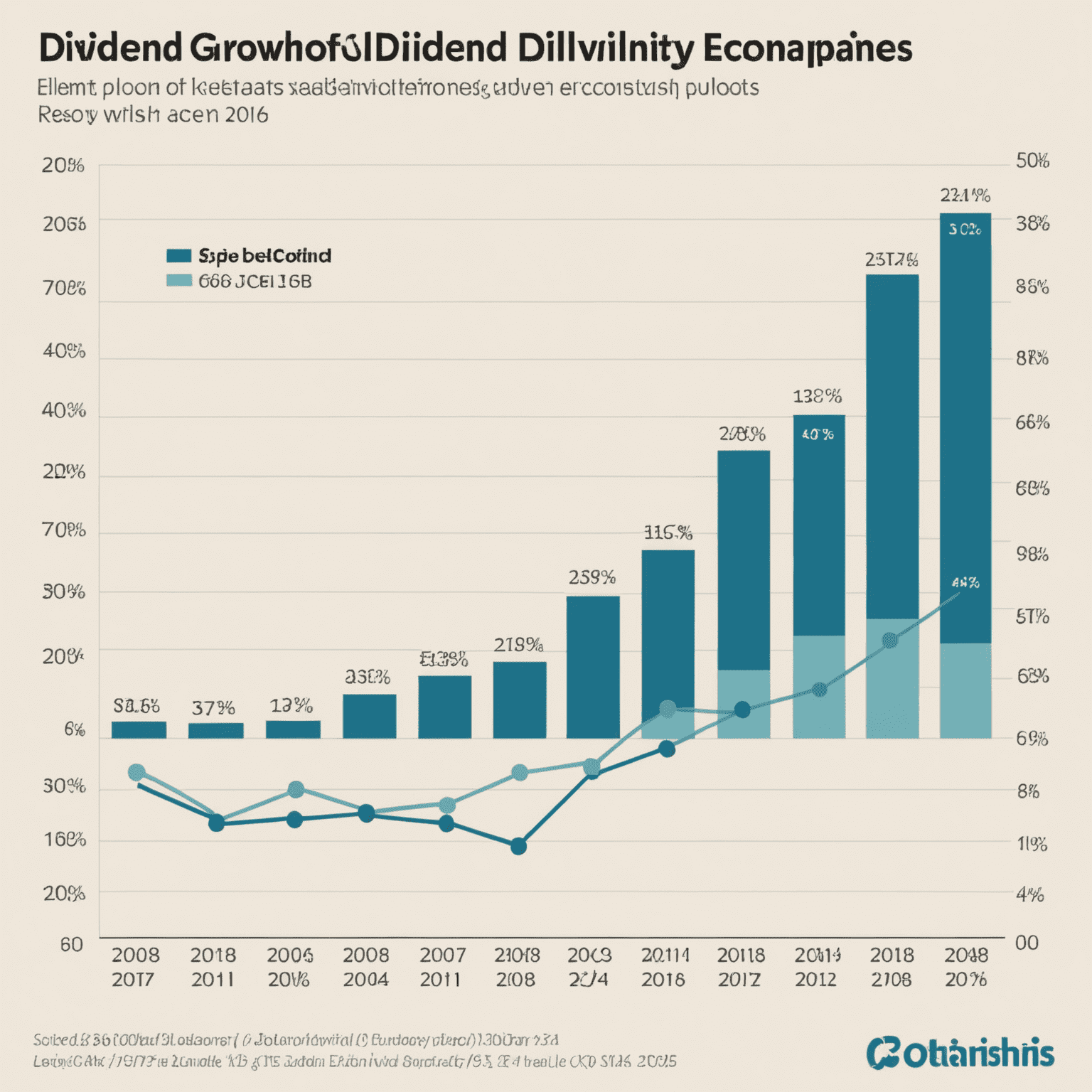

Dividend-Paying Oil Stocks: A Path to Passive Income

Investing in dividend-paying oil stocks can be an excellent strategy for those looking to generate a steady stream of passive income. This approach combines the potential for capital appreciation with regular cash payouts, making it an attractive option for investors seeking to unlock the potential of passive earnings in the oil market.

Why Consider Oil Stocks for Passive Income?

Oil companies, particularly large, established ones, often pay substantial dividends to their shareholders. These dividends can provide a reliable income stream, even when stock prices fluctuate. Here's why dividend-paying oil stocks can be a smart choice for passive income seekers:

- Consistent Cash Flow: Many oil companies generate steady cash flows, allowing them to maintain regular dividend payments.

- High Yield Potential: Oil stocks often offer higher dividend yields compared to other sectors.

- Inflation Hedge: As energy prices tend to rise with inflation, oil stocks can act as a natural hedge against inflationary pressures.

Top Dividend-Paying Oil Stocks to Consider

While it's essential to conduct thorough research before investing, here are some well-known oil companies with a history of paying dividends:

- ExxonMobil (XOM)

- Chevron Corporation (CVX)

- Royal Dutch Shell (RDS.A, RDS.B)

- BP plc (BP)

- Total SE (TOT)

Risks and Considerations

While dividend-paying oil stocks can offer attractive passive income opportunities, it's important to be aware of the risks:

- Oil Price Volatility: The oil industry is subject to price fluctuations, which can affect stock prices and dividend sustainability.

- Environmental Concerns: Increasing focus on renewable energy may impact long-term prospects of oil companies.

- Geopolitical Risks: Global events and political tensions can influence oil prices and company performance.

Building a Passive Income Strategy with Oil Stocks

To maximize your passive earnings potential with oil stocks, consider the following strategies:

- Diversification: Don't put all your eggs in one basket. Invest in multiple oil companies to spread risk.

- Dividend Reinvestment: Reinvest dividends to compound your returns over time.

- Regular Monitoring: Keep an eye on company performance and industry trends to make informed decisions.

- Long-Term Perspective: Dividend investing often works best with a long-term investment horizon.

Conclusion

Dividend-paying oil stocks can offer a compelling path to passive income for investors willing to navigate the complexities of the energy sector. By carefully selecting stable companies with strong dividend histories and maintaining a diversified portfolio, you can potentially unlock a steady stream of passive earnings from the oil market. Remember to always conduct thorough research and consider consulting with a financial advisor before making investment decisions.