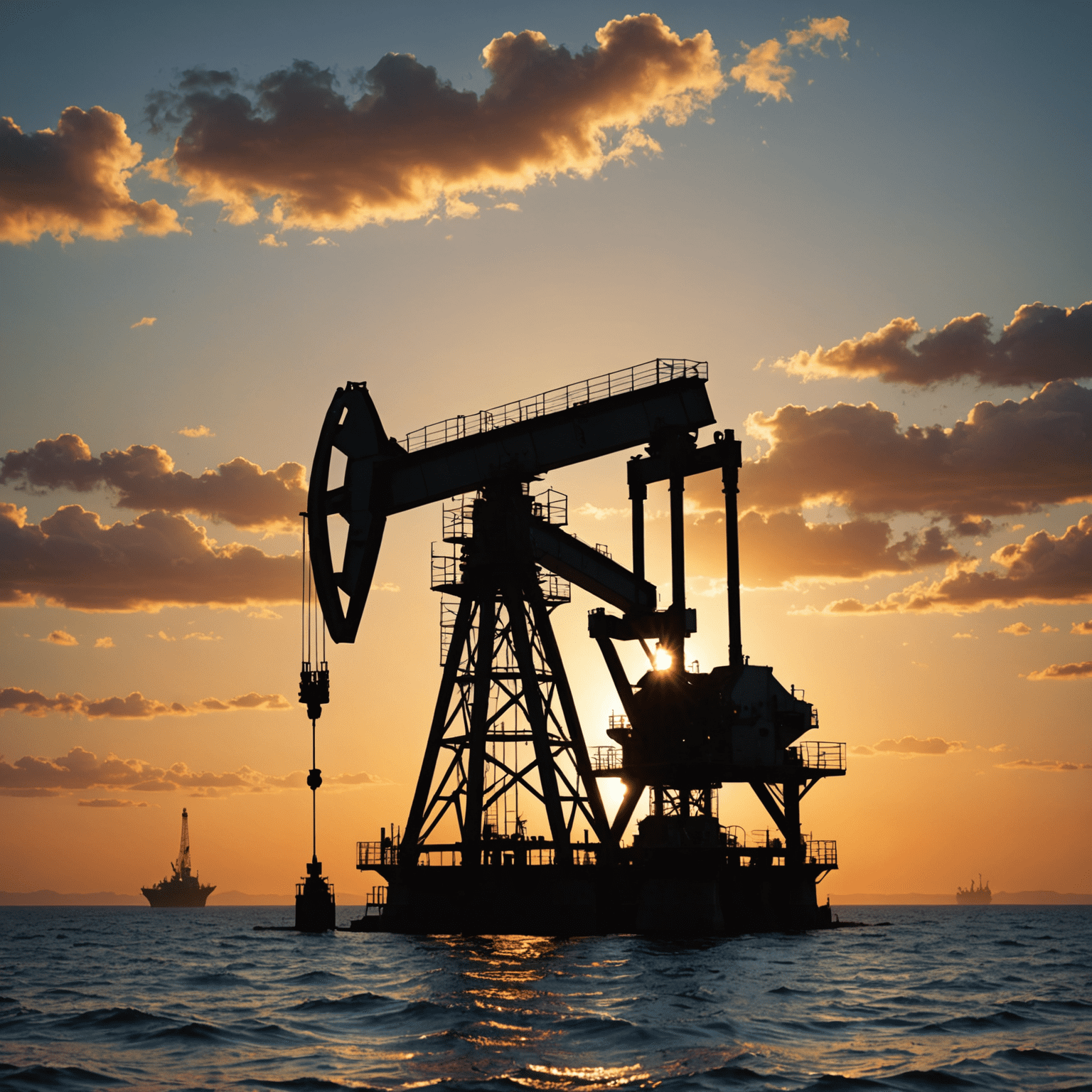

Risk Management in Oil Market Investments

Passive investing in the oil market can be a lucrative venture, but it comes with its own set of risks. Understanding and implementing effective risk management strategies is crucial for long-term success and stable passive earnings.

Key Risk Management Strategies

-

Diversification

Don't put all your eggs in one basket. Spread your investments across different oil companies, regions, and even related sectors to mitigate risk.

-

Stay Informed

Keep abreast of global events, OPEC decisions, and technological advancements that can impact oil prices and market dynamics.

-

Use ETFs

Consider oil-focused Exchange Traded Funds (ETFs) for a more diversified exposure to the oil market, reducing single-stock risk.

-

Hedging

Utilize financial instruments like options or futures to hedge against potential price fluctuations in the oil market.

-

Set Stop-Loss Orders

Implement stop-loss orders to automatically sell your positions if they drop below a certain threshold, limiting potential losses.

Understanding Market Volatility

The oil market is notoriously volatile, influenced by geopolitical events, supply and demand fluctuations, and economic indicators. As a passive investor, it's crucial to:

- Maintain a long-term perspective

- Avoid emotional reactions to short-term price swings

- Regularly rebalance your portfolio to maintain your desired risk level

Leveraging Technology for Risk Management

In today's digital age, various tools and platforms can assist in managing risks associated with oil market investments:

- Risk assessment software

- Real-time market data feeds

- AI-powered predictive analytics

- Automated portfolio rebalancing tools

By leveraging these technologies, you can make more informed decisions and potentially enhance your passive earnings while minimizing risks.

Conclusion

While the oil market offers significant potential for passive earnings, it's essential to approach it with a well-thought-out risk management strategy. By diversifying your investments, staying informed, utilizing appropriate financial instruments, and leveraging technology, you can navigate the volatile oil market more effectively and work towards unlocking the full potential of your passive income stream.